Your business lives and dies by how many new customers it brings in. Too many CEOs, managers and business owners view customer acquisition as a cost to be ruthlessly minimised. But there be gold in them hills. Let’s find out what Customer Acquisition Cost (CAC) means for your ROI.

Customer Acquisition Cost made simplePutting all the buzzwords aside, Customer Acquisition is essentially the act of gaining new customers. That includes the tasks of getting your brand’s message out there, grabbing your audience’s attention and shepherding them towards a purchase. Doing all that costs money, which makes the cost of customer acquisition (or CAC) a handy metric for judging if our marketing ROI is positive or not.

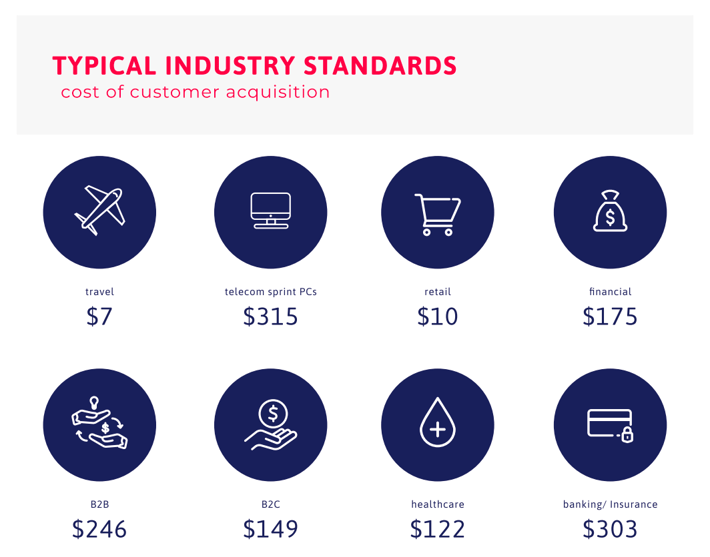

Let’s take a quick look at a few sample acquisition costs across various industries published by Entrepreneur magazine.

Of course, this would vary from industry to industry, but it does illustrate the typical ranges of CAC across different categories.

The handy way to calculate CAC

A simple way to calculate your CAC is to divide all the costs spent on acquiring more customers (including all advertising costs, marketing costs, overheads, salaries of marketers and sales staff, cost of tools, PPC, CPC, etc) by the number of new customers gained over a fixed period of time i.e. weekly CAC, monthly CAC or annual CAC.

.jpg?width=600&name=cac2%20(2).jpg)

For example, if a company spent $50 on marketing in a year and acquired 50 new customers in that time, their CAC would be $1.00.

Though inexact, this figure gives a good idea of how much it costs to gain a new customer.

The cost of customer acquisition is important because it assigns a real, measurable value to your marketing initiatives. It also lets you track your ROI in more concrete terms, which makes it a metric of great interest to CEOs, marketing managers and investors.

You can check out this handy interactive ROI tool to get an idea of what you can expect from your CAC inputs.

“Knowing your CAC helps you calibrate your investment in different acquisition channels.” - Fiona Lee

Don’t slash your CAC just yet

Marketers have a tendency to jump the gun and rush to cut down their CAC right away. It’s a cost and should be minimised ASAP, right? Not so fast. We first have to understand what the CAC actually represents.

The CAC represents only past and present performance, without any consideration for future growth. Short-sighted marketers can become obsessed with immediate growth at any cost, which can lead to very bad business decisions if not tempered with a long-term vision.

The best marketers think about the long game. They understand that the CAC is an investment, not a cost. Their focus is on building sustainable growth on a longer time frame. Having a sound retention strategy in place, such as an abandoned cart recovery strategy, can maximise your CAC and help you make more confident long-term projections.

Make sure you’re getting the full CAC picture

Pure customer acquisition metrics can be dangerously seductive. They appear to sum up your entire marketing performance in one simple metric. But in reality, they are inexact tools for calibrating and scaling your company’s growth. If we want our business to stay scalable and profitable, then we have to consider the Big Three CAC metrics:

- Customer acquisition cost

- Lifetime value

- Payback periods

Power up your CAC decision-making with customer lifetime value (LTV)

CAC, while useful, does not give you all the information you need to make effective business decisions. Every seasoned businessperson knows: costs are NOT always bad!

In any growing business, some ‘costs’ are better viewed as investments. Some investments are smart, some are not. The trick is finding out which is which.

This is where looking at a customer’s Lifetime Value (LTV) comes in. The LTV is the revenue you get from a customer over their entire lifetime of interacting with your business.

Most mature businesses usually use a 1, 3 or 5 year LTV calculation. This can be a challenge for newer companies because there isn’t a large data set available to draw insights from. But it is still an absolutely critical metric for assessing the costs and potential returns of your business decisions.

The LTV/CAC calculation will help answer the critical question: “Will the customers we’re acquiring generate more revenue than their cost?”

.jpg?width=600&name=ltv-cac2%20(1).jpg)

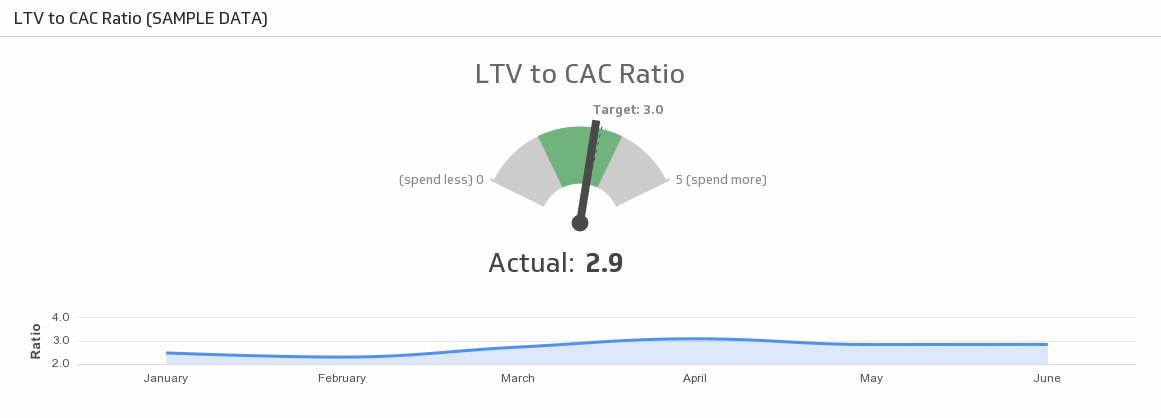

“Strong B2B companies in their growth stage should have a ratio of LTV:CAC of 3-5” - Mike Volpe, former CMO, Hubspot

Like Mike said, an ideal LTV/CAC ratio should be 3:1. The value of your customer should be 3x the cost of acquiring them. If the ratio is close, like say 1:1, you are overspending. If it’s 5:1, you are not spending enough.

“76% of companies see CLV as an important concept for their organisation, yet only 42% of companies are able to measure Customer Lifetime Value (CLV) accurately.” - Khalid Saleh

For an example of LTV in action, look no further than the Amazon Kindle.

“According to Bezos, people who buy Kindles read four times more books than they did before investing in Kindles. The Kindle is, at its heart, a marketing strategy — a strategy that Amazon could only deploy with a solid understanding of a customer’s lifetime value, or LTV.” – Neil Patel

How LTV can increase your CAC limit

Understanding LTV/CAC equation frames your marketing spend in a different light. It can help you determine if you should invest in acquiring larger customers who’ll likely stick around longer and pay more throughout their lifetime.

This is what your “allowable CAC” is. Your allowable CAC is the maximum acceptable amount you could pay to gain a customer. If your LTV is higher, you can make the case for implementing a higher CAC.

To gain an even fuller picture, we should also consider the Payback Period.

What is the CAC Payback Period?

The CAC Payback Period is the number of months it takes to earn back the money invested in acquiring customers. Simply put, it shows your break-even point. Ideally, it should be a part of the CAC assessment.

For any well-managed business, cash flow is always a priority. The CAC payback period helps manage cash flow expectations and gives you a ‘growth timetable’ if you will.

Panning for gold in the mountains of data

The biggest challenge of factoring in CAC, LTV and payback periods in your assessment is that it’s difficult to do. Data is not always easy to make sense of and can be inconsistent, even unreliable, in some cases. Start-ups and new businesses simply don’t have much historical data to begin with.

But just because it’s difficult to do doesn’t mean it’s not important.

Ignoring the historical data you have, or even the data yielded by your marketing automation tools, is not just a waste; it is a wildly irresponsible waste your business cannot afford. Striking the perfect balance between CAC, LTV and ROI is the digital gold that will scale your business repeatedly, profitably and sustainably.

Curious? Furious? Intrigued? We’re always happy to share our knowledge of digital marketing and have a chat about your business. Come on over, we’ll have coffee.